Banks handle every major economic interaction right from everyday digital payments to trillion-dollar capital markets. With customers shifting to cashless transactions, regulatory scrutiny intensifying, and competition rising from fintechs and neobanks, the ability to harness data has become a defining advantage. The institutions leading the industry today are those turning real-time information into smarter decisions, stopping fraud as it happens, simplifying compliance workloads, and personalizing financial services without compromising trust.

That shift is driving banks toward platforms built for streaming intelligence, AI governance, and unified customer insight. The Databricks Data Intelligence Platform has emerged as the modern foundation that brings together data engineering, machine learning, and analytics enabling financial institutions to operate at real-time speed while remaining secure, audit-ready, and regulation-proof.

A recent survey by PwC outlines a staggering global impact of fraud. For example, in the United States alone, the cost to businesses in 2019 reached $42bn, and 47% of surveyed companies experienced fraud in the past 24 months.

Why financial services need real-time data intelligence

- Financial institutions stand out as early adopters of AI, and the results are visible. Banks are already reporting stronger revenue growth, reduced risk exposure, and efficiency gains when decision-making is driven by data.

- At the same time, banks face escalating cyber-attacks, increasingly sophisticated fraud schemes, and mounting global regulatory expectations across AML, KYC, and capital adequacy.

- Traditional point solutions for fraud, AML, and risk operate in silos, each with its own data model and batch pipelines, making it difficult to share signals, respond quickly, or maintain auditready lineage.

Databricks positions its Lakehouse-based Data Intelligence Platform as the answer an environment where data, governance, AI, and analytics live together, in real time, on a secure, cloud-native foundation.

Table of Contents

- Why financial services need real-time data intelligence

- The Core Lakehouse Architecture: Lakehouse, Delta Lake, and streaming

- Applications of Databricks in Banking Industry

- Real-time fraud detection with Structured Streaming

- AML monitoring and KYC analytics at scale

- Risk modeling and Monte Carlo simulations on the Lakehouse

- Real-time transaction analytics and enterprise data intelligence

- Golden customer record and 360° intelligence

- Governance, security and regulatory reporting

- How Sparity can help

The Core Lakehouse Architecture: Lakehouse, Delta Lake, and streaming

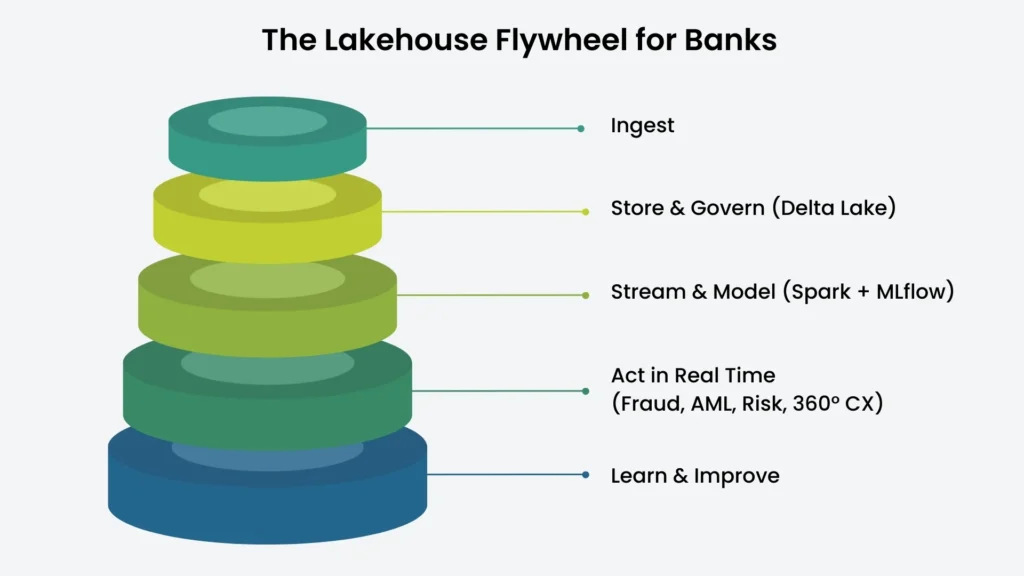

Databricks introduces a modern architecture that supports financial workloads end-to-end.

- Lakehouse for financial data: The Lakehouse combines the openness of data lakes with the reliability of data warehouses, creating a space where payments, trades, digital activity, customer profiles, and risk signals sit together, governed and ready for analytics.

- Delta Lake as the transaction layer: Delta Lake ensures every compliance report, model, and insight is based on clean, accurate data. With ACID guarantees, schema enforcement, time travel, and auditability, teams always know what data changed and why.

- Spark Structured Streaming for real time: Spark Structured Streaming ingests everything from card swipes and ATM withdrawals to app logins and instant transfers almost as soon as they occur. Banks can compute features, run risk models, and act within milliseconds.

- MLflow and Model Serving: MLflow tracks experiments, versions models, and deploys scoring endpoints directly into streaming pipelines critical for fraud, AML, and risk scoring that must adapt constantly.

Together, these building blocks allow banks to move beyond slow, batch-based intelligence and toward truly real-time decisioning.

Applications of Databricks in Banking Industry

Real-time fraud detection with Structured Streaming

Databricks’ financial fraud accelerators show how to build realtime fraud prevention engines that blend rules with machine learning, analyzing billions of transactions for anomalies while reducing false positives. Typical pipelines read from event streams (card networks, payment gateways, mobile apps) into streaming Delta tables, calculate behavioral features per card or account, and call an MLflow managed model for a risk score on each event.

A MongoDB–Databricks reference solution demonstrates an MLbased card fraud system that keeps data complete via external enrichment, performs realtime scoring, and exposes explainable alerts to operations teams.

AML monitoring and KYC analytics at scale

AML and KYC programmes face the same operational pressure as fraud with added regulatory consequences. The Databricks AML accelerator provides a framework for ingesting and correlating customer records, transactions, and global watchlists.

Graph analytics on the Lakehouse can uncover hidden networks, while machine learning prioritises alerts more accurately, reducing strain on investigators. Streaming pipelines enable near real-time monitoring of structuring, cross-border transfers, and abnormal cash flows no more relying solely on next-day batch processing.

With all AML and KYC data in Delta Lake, banks finally gain traceability from reports submitted to regulators back to raw events a critical requirement during audits.

Risk modeling and Monte Carlo simulations on the Lakehouse

Risk teams rely on accurate models to understand market movement and determine the exposure the bank is really carrying. With Databricks, those models finally get the scale they need. Using Spark and Delta Lake, banks can run millions of Monte Carlo simulations across market and credit scenarios without being limited by traditional on-prem grids or slow compute.

Results land directly in Delta tables by powering VaR, expected shortfall, and stress test reporting in near real time. And because every input and output is stored with full lineage and time travel, teams can replay scenarios, validate assumptions, and demonstrate to regulators exactly how final risk numbers were generated.

It’s this combination of scale, transparency, and audit-ready governance that positions Databricks as the modern foundation for enterprise-grade risk analytics not just fraud and AML.

Real-time transaction analytics and enterprise data intelligence

Banks also use Databricks to unify data from retail, corporate, payments, trading, and digital channels. With a single data foundation, institutions can move from static MIS reporting to live operational intelligence.

Common applications include:

- instant spending insights on mobile apps

- real-time credit limit adjustments

- liquidity monitoring across the day

- intraday P&L updates for trading teams

Real-world examples, such as Techcombank, show banks improving fraud detection, sharpening credit analytics, and consolidating customer data all on Lakehouse.

Golden customer record and 360° intelligence

One of the most powerful benefits of the Databricks Lakehouse is the ability to finally bring every customer touchpoint together. Banks can build a true 360° customer record that unifies identity, product holdings, transaction patterns, complaints, digital interactions, risk exposure, and even fraud signals all in one governed place.

This level of visibility strengthens far more than compliance. It fuels growth with smarter next-best-offer models, churn prediction, personalised servicing, and deeper customer understanding across channels. And the real win is consolidation. What once sat in separate fraud platforms, CRM systems, marketing engines, and core banking stores can now run from a single source of truth transparent, trusted, and ready for intelligence at scale.

Governance, security and regulatory reporting

For banks, embracing AI required rock-solid governance. Databricks reinforces this with centralized access controls, data masking for sensitive information, complete audit logs, and lineage tracking mapped to global regulatory expectations. By bringing all financial, risk, and compliance data onto a single Lakehouse, institutions can produce capital, liquidity, AML, and conduct reports from one governed source of truth without reconciling figures from multiple warehouses or point tools.

Industry momentum is already validating this approach. The collaboration between the London Stock Exchange Group and Databricks highlights how AI-ready financial data, combined with capabilities like Agent Bricks, is enabling faster risk analysis and automated regulatory reporting.

These capabilities give banks confidence in their risk scoring, model explainability, and audit preparedness cornerstones for operating in a regulated environment.

How Sparity can help

Modernizing fraud, AML, and risk analytics requires more than new technology. Banks often lack unified platforms, streamlined data flows, and hands-on Databricks expertise needed to execute change.

Sparity bridges that gap by helping financial institutions adopt and deploy Databricks Lakehouse architectures that support real-time intelligence, governed analytics, and scalable AI. We have already seen the impact of this approach. For a leading risk management firm, Sparity helped by implementing a Databricks Medallion Architecture cut data processing times by 50–70%, giving teams the speed and agility to run risk models and make decisions in near real time.

Engagements include:

- Assessing current fraud and AML systems and mapping them to Databricks Lakehouse patterns

- Designing streaming pipelines, feature stores, and MLflow models for real-time decisioning

- Building 360° customer records that integrate risk, fraud, and experience data while meeting regulatory controls

With the right foundation, banks can move from reactive monitoring to proactive, AI-driven intelligence that protects customers, manages risk, and unlocks new value.